Table Of Content

- How to estimate the total effort on your house payments

- Birkin bag thieves prowl L.A.’s rich neighborhoods, fueling a bizarre black market

- What's included in your monthly mortgage payment?

- How to calculate your mortgage payments

- USDA loan (government loan)

- How a Larger Down Payment Impacts Mortgage Payments*

- How much house can I afford?

A $2,000 mortgage is below the average monthly payment but above the median monthly payment in the US. If you can pay $2,000 each month and also comfortably afford other necessities and financial goals, then this might not be too expensive of a mortgage for you. With a longer amortization period, your monthly payment will be lower, since there’s more time to repay.

How to estimate the total effort on your house payments

Homeowners insurance is a policy you purchase from an insurance provider that covers you in case of theft, fire or storm damage (hail, wind and lightning) to your home. Homeowners insurance can cost anywhere from a few hundred dollars to thousands of dollars depending on the size and location of the home. In the drop down area, you have the option of selecting a 30-year fixed-rate mortgage, 15-year fixed-rate mortgage or 5/1 ARM. Escrow is a legal arrangement where a third party temporarily holds money on behalf of a buyer and seller in a real estate transaction. You can think about refinancing (if you already have a loan) or shop around for other loan offers to make sure you’re getting the lowest interest rate possible.

Birkin bag thieves prowl L.A.’s rich neighborhoods, fueling a bizarre black market

There may be an escrow account involved to cover the cost of property taxes and insurance. The buyer cannot be considered the full owner of the mortgaged property until the last monthly payment is made. In the U.S., the most common mortgage loan is the conventional 30-year fixed-interest loan, which represents 70% to 90% of all mortgages. Mortgages are how most people are able to own homes in the U.S. Our mortgage amortization schedule makes it easy to see how much of your mortgage payment will go toward paying interest and principal over your loan term. The median monthly cost of homeownership in the US is $1,775 per month, according to the most recent data from the Census Bureau's 2022 American Community Survey.

What's included in your monthly mortgage payment?

Comer Releases Evidence of Direct Payment to Joe Biden - United States House Committee on Oversight and ... - House Committee on Oversight and Reform

Comer Releases Evidence of Direct Payment to Joe Biden - United States House Committee on Oversight and ....

Posted: Fri, 20 Oct 2023 07:00:00 GMT [source]

Using the Rocket Mortgage calculator is a good way to get started. This calculator can help you determine the type of home you can afford. And you can tweak things like the home price or loan terms to find the best mortgage options for your budget. And when you’re searching for a mortgage, the home price is the most easily adjustable factor. For example, you can’t negotiate on the property taxes in your state, but you can always try to negotiate a lower price on your home.

Based on Census Bureau data, the median home value in San Francisco County is $1,152,300. In Santa Clara County, median home values fall a bit to $1,061,900, while Marin County has a median value of $1,053,600. California also has what’s called the FAIR plan which offers coverage to all property owners as a last resort. This is your option if you can’t find insurance coverage anywhere else on the voluntary market. The coverage is not comprehensive (meaning it doesn’t cover all situations), but provides the absolute basic level of home insurance.

USDA loan (government loan)

So you need to build a rainy day fund, because odds are against you that one day the air conditioner will fail or the roof will leak or one of your major appliances will go on the blink. Without an emergency fund, these types of events can put you in the red. Lawn mowers, weed whackers, hedge trimmers, etc. will be an immediate expense. If you live in a neighborhood with a homeowners association, monthly or quarterly fees may be required. You may say that you don't want to be locked into that higher payment and that you'll simply add extra each month to reduce some of that interest? Life happens, and the extra money slides through your fingers for things you no longer remember.

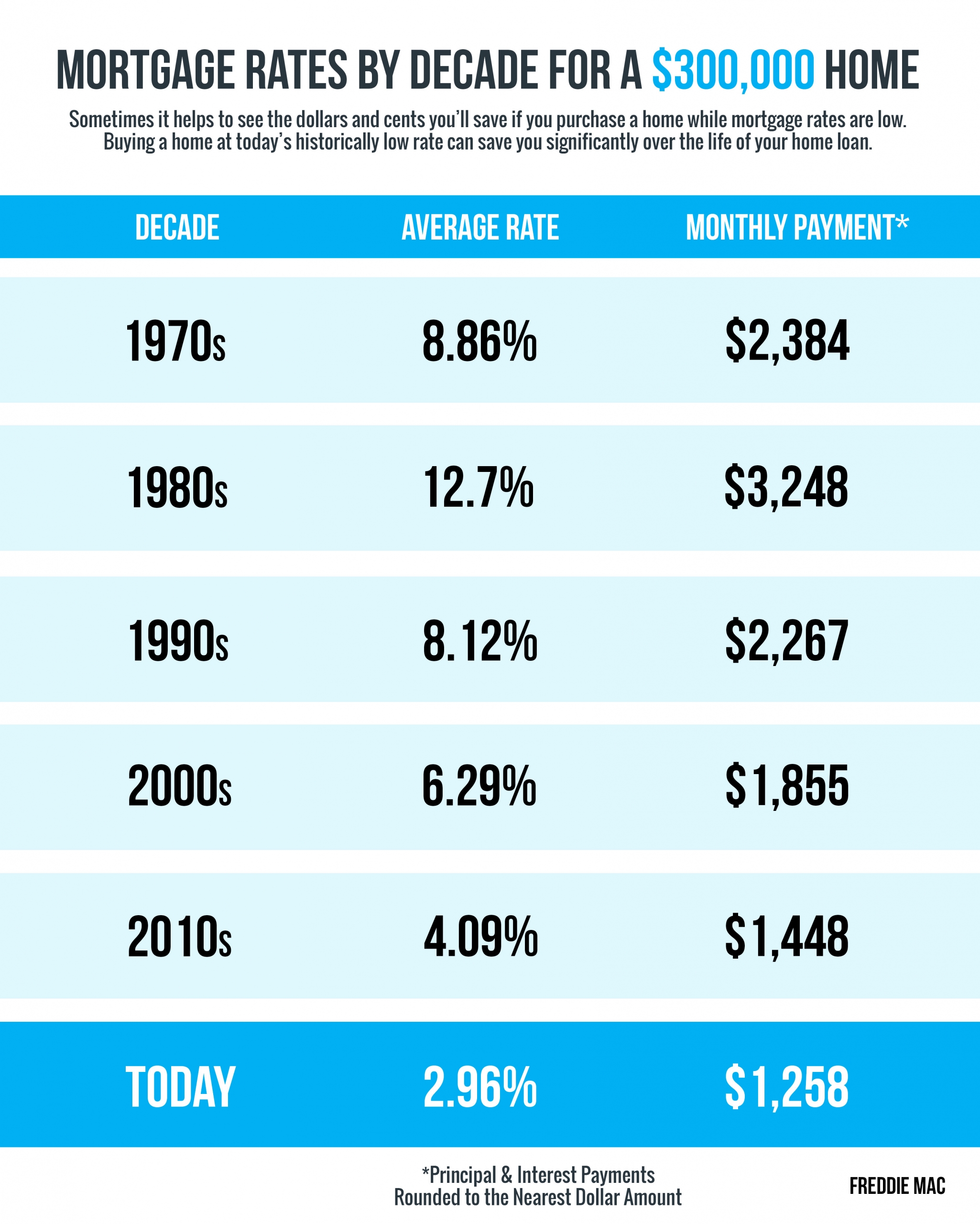

If you secure a fixed mortgage rate your payments won't be impacted by future rate hikes. By default we show 30-year purchase rates for fixed-rate mortgages. You can switch over to refinance loans using the [Refinance] radio button.

Home Ownership Affordability Monitor - Federal Reserve Bank of Atlanta

Home Ownership Affordability Monitor.

Posted: Tue, 19 Mar 2024 07:00:00 GMT [source]

How much house can I afford?

Another factor to strongly examine when looking at average and median mortgage payments is location. This is because both home prices and mortgage interest rates vary widely between states. If you want to know what your mortgage payment might look like, try a mortgage calculator to estimate your total housing costs.

How to calculate the monthly payment on a mortgage

Adjustable-rate mortgage (ARM) loans are listed as an option in the [Loan Type] check boxes. Alternate loan durations can be selected and results can be filtered using the [Filter Results] button in the bottom left corner. You can select multiple durations at the same time to compare current rates and monthly payment amounts.

The FHA also offered further help amid the nationwide drop in real estate prices. It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve. Today, both entities continue to actively insure millions of single-family homes and other residential properties. Mortgage interest is the cost you pay your lender each year to borrow their money, expressed as a percentage rate.

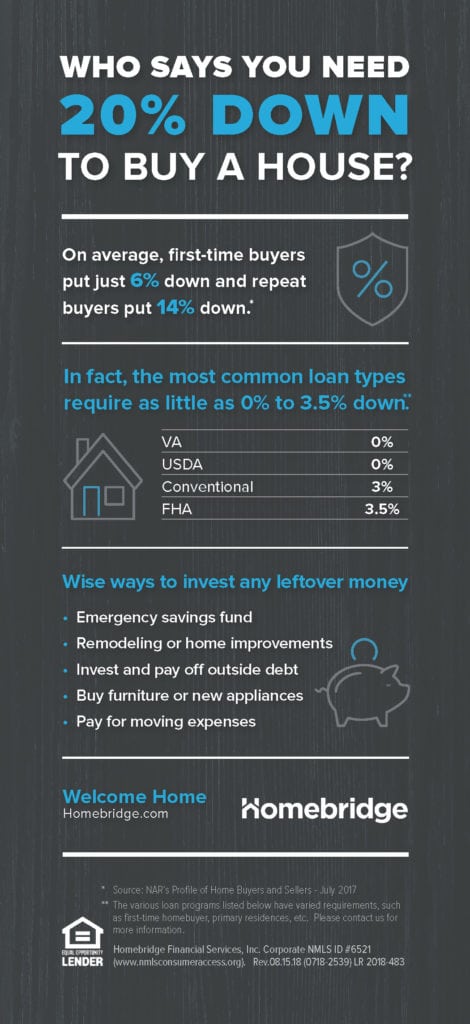

You can still obtain a conventional loan with less than a 20% down payment, but PMI will be required. Let’s learn more about how a mortgage calculator works, and the different factors it uses to determine your monthly mortgage payments. This house payment calculator estimates the monthly payment on your mortgage loan by considering the amount borrowed, term and interest rate plus taxes & PMI. There is in depth information on how to figure out the level of the total out of pocket you will regularly pay below the tool. In order to make an amortization schedule, you'll need to know the principal loan amount, the monthly payment amount, the loan term and the interest rate on the loan.

Based on the details provided in the amortization calculator above, over 30 years you’ll pay $351,086 in principal and interest. Property taxes in California are a relative bargain compared to the rest of the nation. With limits in place enforced by Proposition 13, generally property taxes cannot exceed 1% of a property’s market value.

Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance. Adding different information to the mortgage calculator will show you how your monthly payment changes. Feel free to try out different down payment amounts, loan terms, interest rates and so on to see your options. You may enter your own figures for property taxes, homeowners insurance and homeowners association fees, if you don’t wish to use NerdWallet’s estimates. Edit these figures by clicking on the amount currently displayed. A mortgage calculator can help you get a realistic idea of the type of home you can afford.

Principal and interest are not the only expenses tied to the loan. Your county wants some of your money and so does your insurance company, so be prepared for property taxes and homeowners insurance. The more expensive the house, the more both of these will cost. Most people roll these two charges into their monthly mortgage.

In the late 1990s, estimates about his net worth varied from $850,000 to $15.7 million. LaVergne declined to disclose the estimated value and said he had just begun an inventory. He said there may be value in Simpson’s possessions simply because he owned them, which could increase the value of the overall estate. Americans are expected to buy 4.46 million existing homes this year, a 9% increase from 2023.

No comments:

Post a Comment